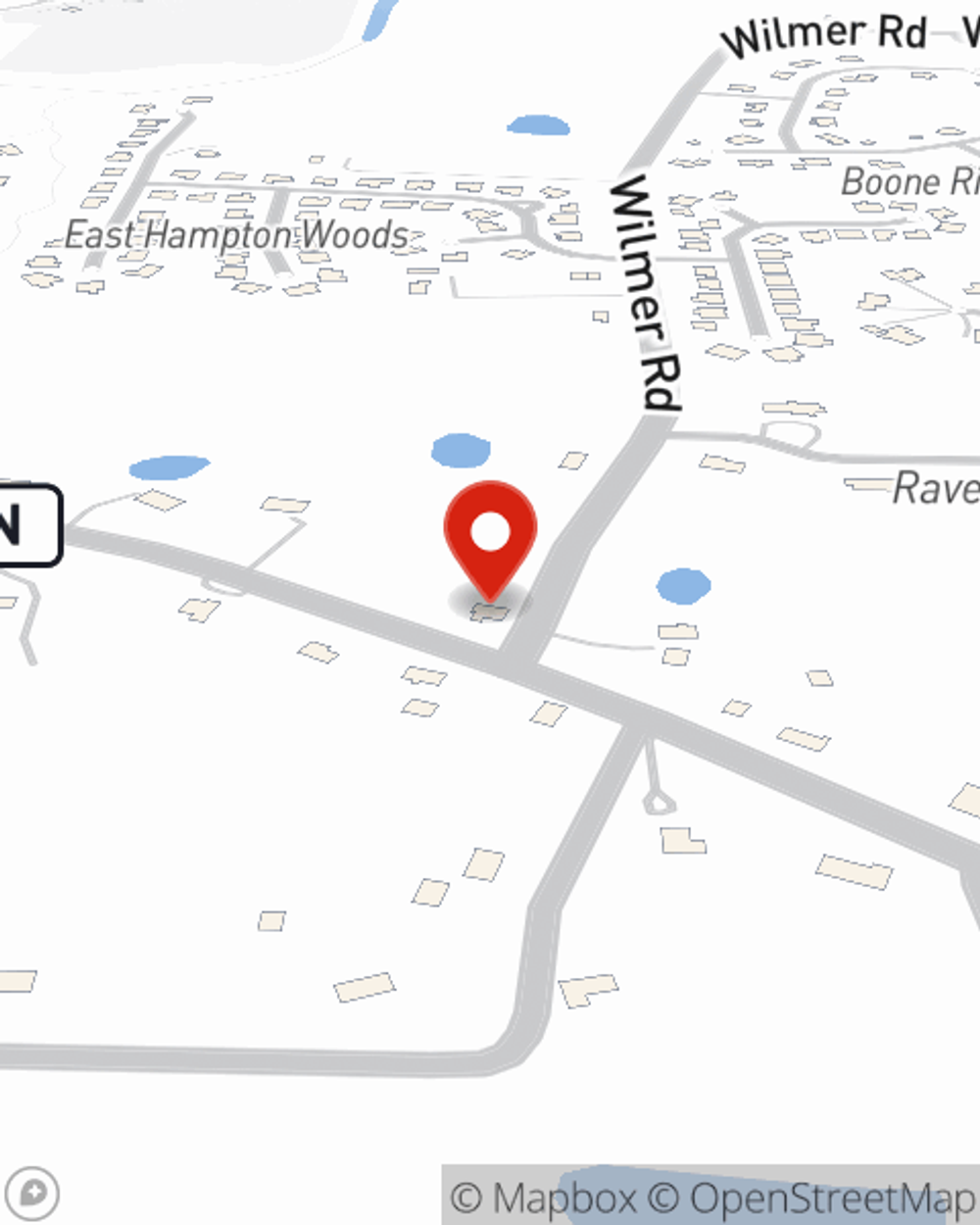

Business Insurance in and around Wentzville

One of Wentzville’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

- Wentzville

- Lake St. Louis

- New Melle

- St. Charles

- Ofallon

- Foristell

- Augusta

- Wright City

- Warrenton

- Cottleville

- Troy

- Moscow Mills

- St. Louis County

- St. Charles County

- Warren County

- Lincoln County

Business Insurance At A Great Value!

Though it's not fun to think about, it is good to recognize that some things are simply out of your control. Accidents happen, like an employee gets injured on your property.

One of Wentzville’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Protect Your Business With State Farm

Protecting your business from these potential mishaps is as easy as choosing State Farm. With this small business insurance, agent Mike Hebert can not only help you design a policy that will fit your needs, but can also help you submit a claim should an accident like this arise.

So, take the responsible next step for your business and visit with State Farm agent Mike Hebert to explore your small business insurance options!

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Mike Hebert

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.